NewCode Investment Managers

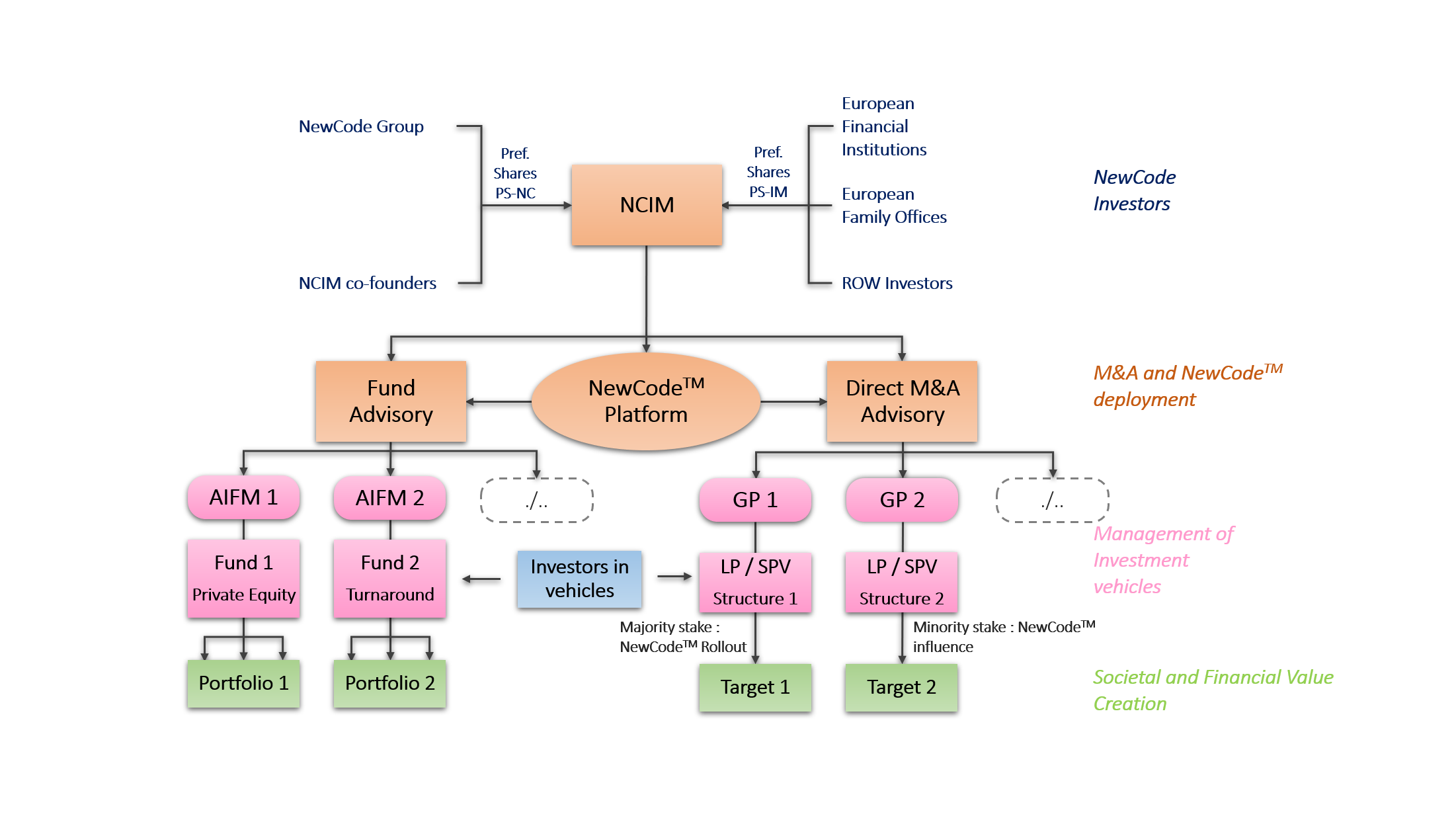

NewCode Conseil currently advises its parent company NewCode Holding on the setting up of NewCode Investment Managers (“NCIM”), which will be the first dedicated asset manager for emancipatory capital: NCIM will propose institutional investors and other professional investors clients with investment vehicles and strategies seeking to create financial value through/benefit from the deployment of NewCode ™ in portfolio companies, in two main categories:

Investment funds

Private Equity like investment funds, intended to acquire controlling stakes in the capital of French and European companies in order to roll out the NewCode ™ business model, in association with all stakeholders. NCIM will rely on experienced teams in the field of Private Equity, and enjoying market recognition in their area of expertise, whether sectoral or situational.

Ad hoc acquisition vehicles

Unlike investment funds, these will be special purpose vehicles set up to acquire a controlling position in the equity of one single company. This strategy will target medium to large corporates going through an exceptional situation which makes an emancipation process through the deployment of NewCode ™ particularly relevant for its stakeholders.

In both cases, NCIM will provide its teams in charge of investment funds or ad hoc vehicles a NewCode ™ platform allowing them to differentiate themselves from their competitors in the areas of recruitment, fundraising, target identification and approach, and societal and financial value creation in portfolio companies.